News

2025 in Review and Looking Ahead to 2026!

2025 in Review: Expanding Financial Inclusion Training

Throughout 2025, I delivered a series of specialist trainings on refugee and migrant finance, working with organisations committed to supporting displaced and marginalised communities. Sessions were provided for Refugees at Home, Breadwinners, Northumberland County Council, and Rooted Finance, covering themes such as debt, credit, remittances, informal lending networks and the realities of financial exclusion.

These sessions brought together frontline staff, volunteers and community practitioners to explore how financial systems intersect with integration, resilience and everyday decision‑making across diverse migrant cohorts.

Looking Ahead to 2026!

In 2026, this programme of work will continue to grow, with upcoming training already arranged for the Financial Conduct Authority (FCA) general team, the FCA Illegal Money Lending Team, and Routes. The focus will remain on equipping organisations with the knowledge needed to understand culturally‑embedded financial practices and to better support refugees and migrants navigating the UK’s financial landscape.

Visit to Rooted Finance – Sharing Insights on Refugee & Migrant Finance

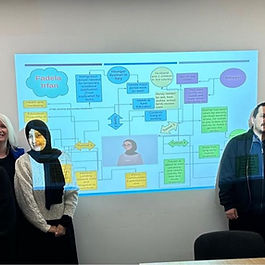

On October the 15th 2025, I had the pleasure of visiting Rooted Finance at their Bethnal Green office to deliver my training session, “An Overview of Refugee and Migrant Finance: Contextualising Debt, Credit, Financial Exclusion and Its Impact on Integration.”

It was an engaging and energising session with staff who themselves are part of diverse diaspora communities. The conversations that followed were particularly powerful, many colleagues shared personal memories and community observations about how people navigate financial life beyond mainstream systems.

We discussed topics such as:

-Remittances as a core part of household and transnational family budgeting

-Informal lending networks, including rotating savings groups and reciprocal community-based credit

-Solidarity funding and mutual aid, driven by trust and cultural norms

-How financial exclusion shapes day‑to‑day decision‑making and long‑term integration

-The challenges traditional financial services face in understanding these practices across different migrant cohorts

These insights reinforced how essential it is for organisations to recognise the financial strategies that refugees and migrants already use, and how policy and practice can better support them.

A huge thank you to the Rooted Finance team for hosting me and for such thoughtful, informed discussion. I look forward to continuing the conversation.

Our Director Josh Aspden, Featured in Reuters news Article

Scammers and loan sharks target debt-ridden migrants in UK

by Lin Taylor

https://www.context.news/socioeconomic-inclusion/scammers-and-loan-sharks-target-debt-ridden-migrants-in-uk